What is Climate Value At Risk (CVaR)?

- Get link

- X

- Other Apps

Source: Built the below explanation by modifying the base article sourced from Philippe Jorion's Orange County Case

(Below article is a 6 mins reading time)

CVaR or Climate Value at Risk is a variation of the standard Value at Risk (VaR). It is important to understand VaR first.

VAR summarizes the predicted maximum loss (or worst loss) over a target horizon within a given confidence interval.

How can we compute VAR?

Assume you hold $100 million in medium-term notes.

How much could you lose in a month? As much as $100,000? Or $1 million? Or $10

million? Without an answer to this question, investors have no way to decide

whether the returns they receive is appropriate compensation for risk.

To answer this question, we first have to analyze the characteristics of

medium-term notes. We obtain monthly returns on medium-term bonds from 1953 to

1995.

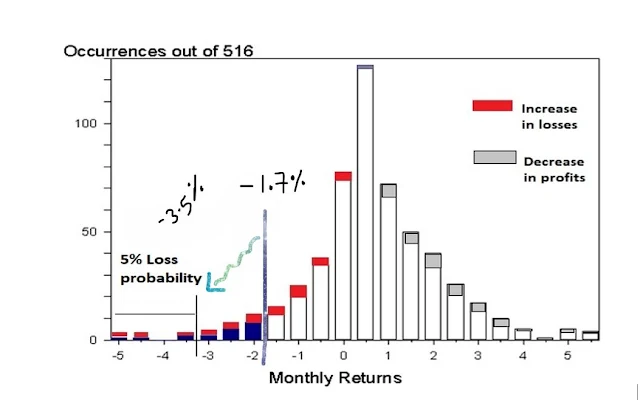

Figure 1

Returns ranged from a low of -5% to a

high of +5.0%. Now construct regularly spaced ``buckets'' going from the lowest

to the highest number and count how many observations fall into each bucket.

For instance, there is one observation below -5%. There is another observation

between -5% and -4.5%. And so on. By so doing, you will construct a

``probability distribution'' for the monthly returns, which counts how many

occurrences have been observed in the past for a particular range.

![]()

Figure 2

For each return, you can then compute a

probability of observing a lower return. Pick a confidence level, say 95%. For

this confidence level, you can find on the graph a point that is such that

there is a 5% probability of finding a lower return. This number is -1.7%, as

all occurrences of returns less than -1.7% add up to 5% of the total number of

months, or 26 out of 516 months. Note that this could also be obtained from the

sample standard deviation, assuming the returns are close to normally

distributed.

Therefore, you are now ready to compute

the VAR of a $100 million portfolio. There is only a 5% chance that the

portfolio will fall by more than $100 million times -1.7%, or $1.7 million. The

value at risk is $1.7 million. In other words, the market risk of this

portfolio can be communicated effectively to a non-technical audience with a

statement such as:

Under normal market conditions, the most the portfolio can lose over a

month is $1.7 million.

What is the effect of

VAR parameters?

In the previous example, VAR was reported at the

95% level over a one-month horizon. The choice of these two quantitative

parameters is subjective.

(1) Horizon

For a bank trading portfolio invested in highly liquid

currencies, a one-day horizon may be acceptable. For an investment manager with

a monthly rebalancing and reporting focus, a 30-day period may be more

appropriate. Ideally, the holding period should correspond to the longest

period needed for an orderly portfolio liquidation.

(2) Confidence Level

The choice of the confidence level also depends on

its use. If the resulting VARs are directly used for the choice of a capital

cushion, then the choice of the confidence level is crucial, as it should

reflect the degree of risk aversion of the company and the cost of a loss of

exceeding VAR. Higher risk aversion, or greater costs, implies that a greater

amount of capital should cover possible losses, thus leading to a higher

confidence level. In contrast, if VAR numbers are just used to provide a

company-wide yardstick to compare risks across different markets, then the

choice of the confidence level is not too important.

Remember: The

VaR always calculates the potential loss of an investment with a given time

frame and confidence level.

How

can we convert VAR parameters?

If we are willing to assume a normal distribution

for the portfolio returns, then it is easy to convert one horizon or confidence

level to another.

As returns across different periods are

close to uncorrelated, the variance of a T-day return should be T times the

variance of a 1-day return. Hence, in terms of volatility (or standard

deviation), Value-at-Risk can be adjusted as:

VAR(T days) = VAR(1 day) x SQRT(T)

Example: Suppose for Variance for 1-day is “v”. So, the variance for 30

days can be calculated as = v x square-root(30)

Conversion across confidence levels is

straightforward if one assumes a normal distribution. From standard normal

tables, we know that the 95% one-tailed VAR corresponds to 1.645 times the

standard deviation; the 99% VAR corresponds to 2.326 times sigma; and so on.

Therefore, to convert from 99% VAR (used for instance by Bankers Trust) to 95%

VAR (used for instance by JP Morgan),

VAR(95%) = VAR(99%) x 1.645 / 2.326.

How can you use VAR?

This single number summarizes the portfolio's

exposure to market risk as well as the probability of an adverse move. It

measures risk using the same units as the bottom line---dollars. Investors can

then decide whether they feel comfortable with this level of risk.

If the answer is no,

the process that led to the computation of VAR can be used to decide where to

trim risk. For instance, the riskiest securities can be sold. Or derivatives

such as futures and options can be added to hedge the undesirable risk. VAR

also allows users to measure incremental risk, which measures the

contribution of each security to total portfolio risk. Overall, it seems that

VAR, or some equivalent measure, is an indispensable tool for navigating through

financial markets.

Let us now try to

understand CVaR (Climate Value at Risk)

CVaR indicates the impact of Climate on VaR. Let us extend the example to take into account the losses due to the climate on the profit loss probabilities as indicated in the histogram. I have modified the histogram as shown below. The difference that you will observe is that I have highlighted the losses increase in red colour. You can treat an increase in loss proportional to the red boxes on top of each of the bar. So, the losses bars indeed resemble lipsticks 😊 While I have shown the profits are decreasing due to the climate impacts as shown in grey areas. Each grey boxes on right hand side of the mean indicate a decrease from the original value. Size of each grey box indicates proportional decrease in profit.

So what is the impact?

Let us again pick a confidence level, say

95%. For this confidence level, you can find on the graph a point that is such

that there is a 5% probability of finding a lower return. Due to the increased

losses, the point at which we get the sum of lowest 5% shifts to the left. This

means in the previous histogram where we had - 1.7% as the point below which we

got returns lower than 5% has shifted to about -3.5%.

Therefore, you are now again ready to compute the VAR of a $100 million portfolio. There is only a 5% chance that the portfolio will fall by more than $100 million times -3.5%, or $3.5 million.

So, it can be said that 95% VaR of the

said portfolio is $3.5 million. This means it can be said with 95% confidence

that the portfolio of 1 Million USD will not incur losses more than $3.5

million over a month.

So, to end with: Is it good to have a CVaR value as big or as small as possible?

Please share your response in the comment.

- Get link

- X

- Other Apps

Comments

.png)

This is perfect, thanks for so eloquently explaining the concept!

ReplyDeleteThank you. Glad to know.

DeleteThanks a lot! To answer your question in the end. It‘s good to have a CVaR as low as possible as CVaR predicts the maximum loss

ReplyDeleteThanks for your feedback. As a follow up question, is it better to have 92% CVaR of $1 million or 98% CVaR of $1 million?

Delete98% CVaR

DeleteWhy 98% CVaR is better?

Delete98% CVaR is better as there is 98% confidence that the portfolio will not fall by more than 1m or in other words, there is only a 2% probability that the portfolio will fall more than 1m (compared to 8% probability that it will fall more than 1m)

DeleteBulls eye! @Natascha, you are right.

Delete